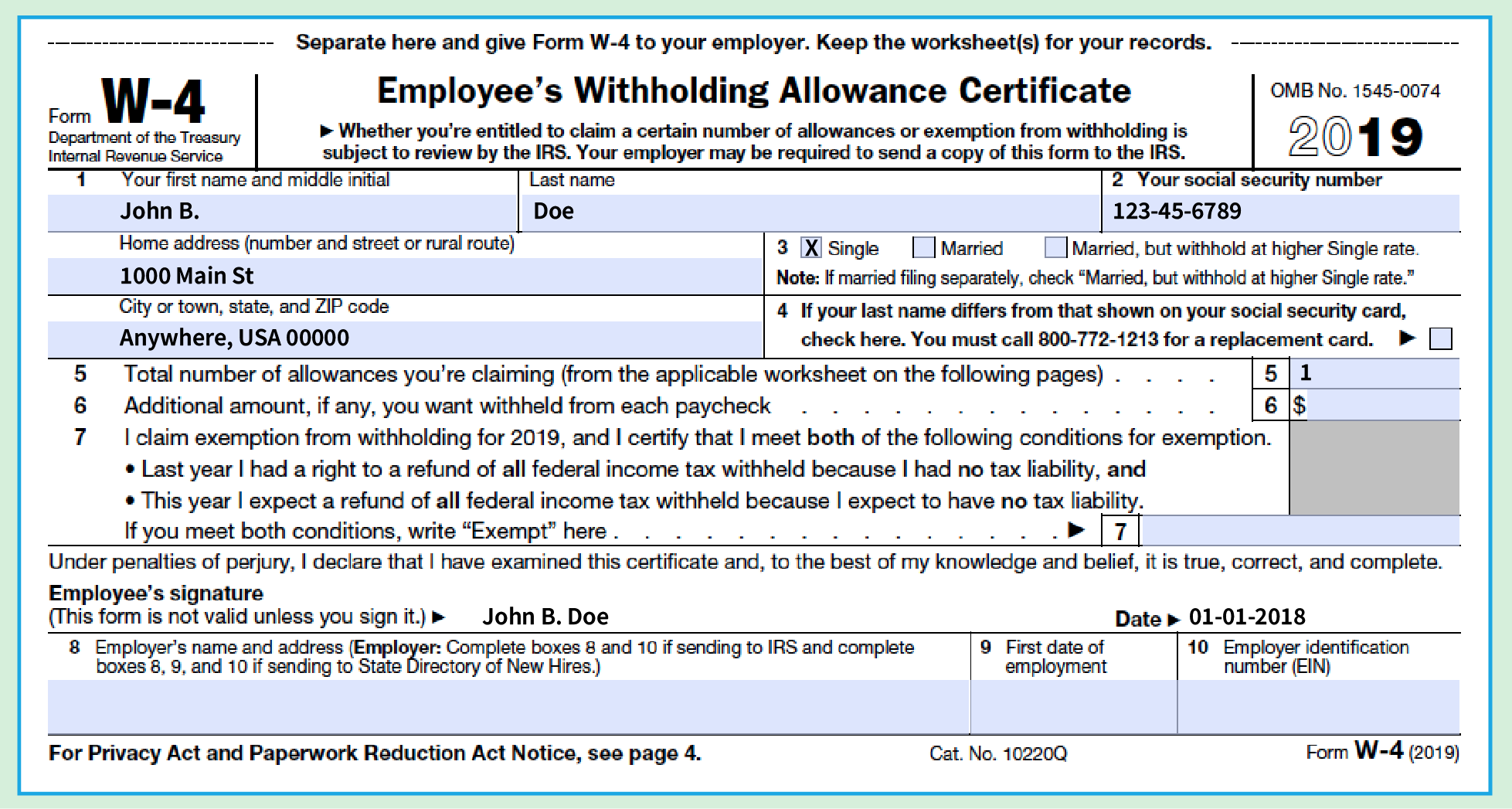

If a due date falls on a Saturday, Sunday, or legal holiday, the due date becomes the next business day. Withholding Returns are due the 15th day of the month following the period. Your employer may have to share your W-4 with the Internal Revenue Service (IRS). You, therefore, need to complete your 2021 W-4 Form so your employer can calculate how much federal taxes to withhold from your paycheck. When you are employed, the IRS expects that you pay federal taxes. If so, you will not need to use TAP to file and pay. Only employed individuals are required to fill up a W-4 Form.

W4 FORM 2021 SOFTWARE

If you use a software package, it is likely your software company is participating in FSET and has the capability to transmit returns and payment information to the DOR in bulk. FSET Availableīulk filing through the FSET program (Fed/State Employment Taxes) is available. TIP: To be accurate, submit a 2021 Form W-4 for all other jobs. You can enter or upload your W2s or 1099s on TAP. Complete Form W-4 so that your employer can withhold the correct federal income tax from. The taxpayer may be subject to penalties if they issue more than 25 W-2s and do not file as required.

W2 / 1099Įmployers that issue 25 or more W-2s are required to electronically submit those to the DOR. the employer must use Single with Zero withholding allowance. Register for online access to existing Withholding tax accounts.

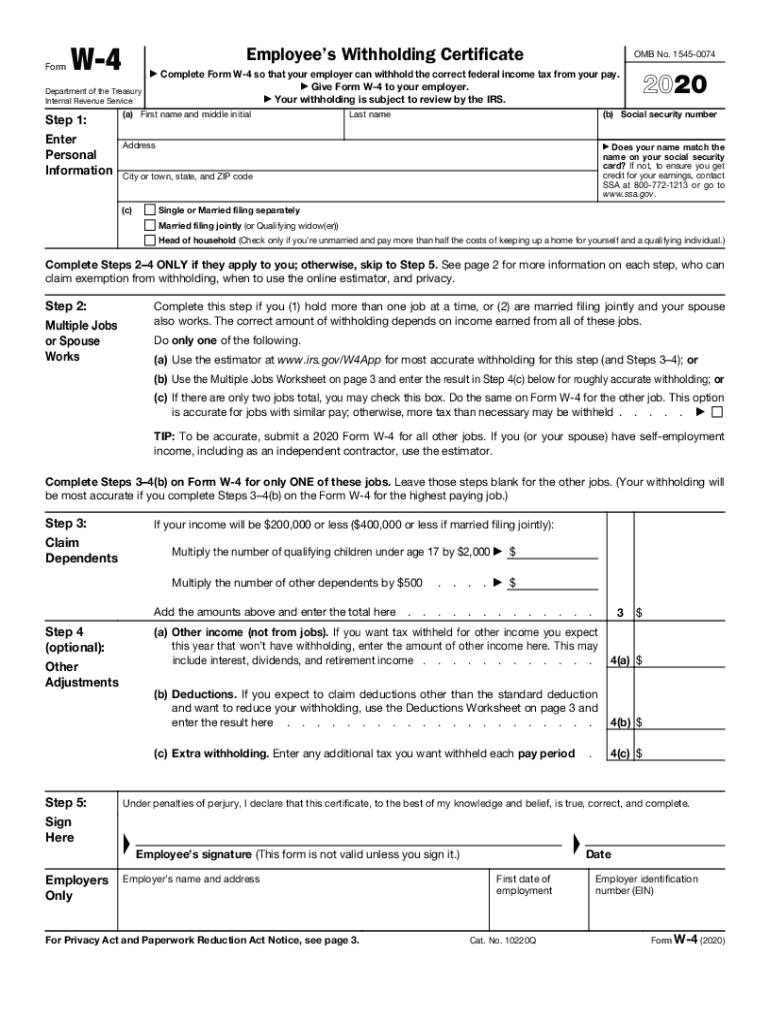

Go to TAP and follow instructions for registration. Register for a new Withholding Account using TAP. Due to the federal tax law changes made by the 2018 Tax Cuts and Jobs Act, effective January 1, 2020, all employers must use the new W-4 Form for New. If you are unsure of some items, always consult with your financial adviser.Your Withholding Tax account is available for viewing and access in TAP. Once again, make sure you provide accurate information on your W-4. vidual estimated income tax form IT 1040ES even though exemptions previously claimed by you decreases because: Ohio income tax is being withheld from their. This enables you to quickly access the forms whenever you need them. W-4 2021 Employees Withholding Certificate Form W-4 Department oftheTreasury InternalRevenue Service Employee’s Withholding Certificate FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Complete Form W-4 so that your employer can withhold the correctfederal income tax from your pay.

W4 FORM 2021 PDF

You should keep all the forms in one place for easy organization, for example in PDF Expert on your iPad or iPhone. Make sure you select the correct marital status box as it will also affect the amount of tax withheld from your paycheck. Until then, you may use the 2021 W-4 version to make any changes to your withholdings. As soon as a new form is released we will notify you.

W4 FORM 2021 FREE

On the other hand, if you overreport your deductions, you will end up with a smaller take-home amount in your paycheck, but a larger tax refund at the end of the year which is like giving the IRS a free loan. The 2022 Form W-4, Employee’s Withholding Certificate, has not yet been released by the IRS. are based on your employees federal W-4 form and the Utah income tax withholding tables. If you do not, your employer may withhold Arizona income tax from your wages and salary until you submit an updated Form A-4. Proper calculation of the number of deductions is extremely important to avoid surprises during the tax season as you may end up owing money to the IRS. General Information How Much to Withhold Forms Youll Need. Misspelling your name or SSN in the W-4 form will most likely result in your employer rejecting it so make sure the information is entered correctly. That is why we have prepared a list of common mistakes to avoid while you are filling out your Form W-4.

Many have found this out the hard way - even a small typo in any of the Name fields could cost you big. However, mistakes on your tax forms can prove to be costly.

0 kommentar(er)

0 kommentar(er)